Types Of Fringe Benefits In HRM: Policy To Retain Motivation

I think almost every organisation deals with unproductive, lazy employees or employees with no motivation.

And to avoid this kind of situation, every now and then, organisations have to work on different types of employee (incentives), employee engagement, fringe benefits or employee benefits.

Providing various types of fringe benefits in HRM to employees assists in encouraging them to stay more loyal and dedicated to their work.

A fringe benefit in HRM conveys an additional compensation to regular wage to specific employees for their extraordinary performance. Indeed, there are different types of fringe benefits in HRM, for instance, health insurance, retirement security plans, employee discounts, dinner plans, etc.

In this blog, we will illustrate different types of fringe benefits in HRM and also open up the impacts of providing fringe benefits to employees.

What Is Fringe Benefits In HRM?

Fringe benefits in HRM are similar to employee benefits provided by organisations.

The smart twist is that employee benefits are provided to every employee. But fringe benefits are only provided to those specific employees who accomplished extraordinary contributions.

And yes, of course, fringe benefits are an additional compensation to the stated salary and are also tax-exempt for employees.

In short, a fringe benefit is a sort of employee benefit which an employee receives in addition to their stated salary. Some of the common fringe benefits:

- Employee discount

- Health/life insurance

- Subsidise meal facilities

- House rent facilities

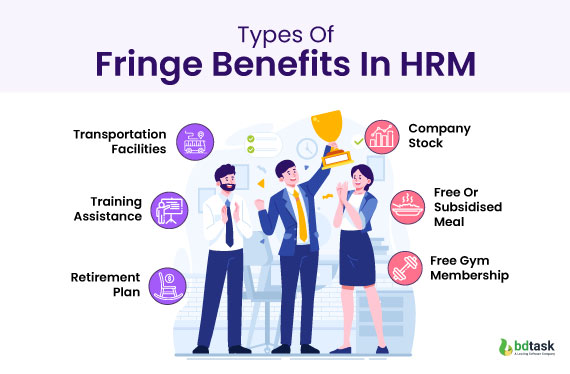

Top 15 Types Of Fringe Benefits In HRM

Indeed, there are many different types of fringe benefits in HRM. But not every type is required by law; some organisations are made just to appreciate the employees.

1. Company Stock

Allow employees to have a small amount of ownership of the company by purchasing company shares, which will also make them feel authoritative. Employees will receive a profit share if the company succeeds in the market.

2. Free Or Subsidised Meal

Companies can provide free or subsidised meals, catered lunch, coffee or evening snacks as a form of fringe benefit.

3. Free Gym Membership

Now, every organisation maintains an in-house gym department so that employees are encouraged to stay fit. As a fringe benefit, the company can provide a free pass to spend hours in the gym.

4. Transportation Facilities

One of the common problems for the employees who stay far from the company's location. So, organisations can provide transportation assistance as a fringe benefit. Transportation assistance such as office bus, separate parking spot, or monthly subsidised gas compensations.

5. Training Assistance

Fringe benefits can also come as compensation for training assistance. After all, it helps to gain knowledge and skills to complete the task in a more efficient way.

6. Life, Dental And Vision Insurance

Every organisation provides different types of insurance schemes to their employees to keep them safe and financially protected. Insurance schemes cover different types of insurance plans such as life, dental, vision, car & house etc.

7. Childcare Compensate

Offering in-house child care or compensating the child care centre cost is another type of fringe benefit which an organisation can provide to the working parents.

8. Unlimited Paid Time Off (PTO)

Even Though a specific number of PTO days is fixed for every employee, organisations still provide an unlimited number of PTO to specific employees for their extraordinary accomplishments.

9. Discounted Amusement Park Ticket

Another beneficial fringe benefit is getting free coupons for amusement park tickets to enjoy the weekend with friends or family. This strategy also works as motivation to enjoy your own personal life apart from work life.

10. Retirement Plan

Every organisation must keep a ensured backup plan for the employees' rest in the future. But it's also true that only the employee with extraordinary accomplishments will get these retirement facilities.

11. Compensating Mobile Bill

Another trendy type of fringe benefit in HRM is paying the mobile bills of employees. Most organisations now pay mobile bills of the employees, which were wasted in companies' usage.

12. House Rent

Another beneficial fringe benefit is providing house rent for the employees. However, an organisation will indeed provide this type of fringe benefit in HRM only to some higher-level employees.

13. Free Or Discounted Lodging

Another popular type of fringe benefit is getting free or discounted lodging facilities. The organisation will bear all the expenses if they take employees to any hotel or resort for official purposes or an annual day picnic.

14. Working Condition Benefits

Usually, these types of fringe benefits are provided to all employees. Working condition benefits include everything an employee needs to work in office premises comfortably. Working condition benefits include comfortable chairs, a monitor, internet, a separate table, and of course a healthy environment.

15. Payment Without Working

Even Though this fringe benefit is one the costliest ones, not every organisation allows it to be enjoyed. Only the employees with exceptional cases get these kinds of opportunities.

Payment without working benefits involves casual leaves, medical leaves, earned leaves, holidays & maternity leave. The main purpose for providing this blog is so that employees feel fresh and motivated to be more productive.

Purpose Of Fringe Benefits

The main objective of providing fringe benefits is to show how an organisation cares for its staff's standard of living. Below, I'm going to provide some extremely beneficial points for offering fringe benefits to your employees.

- Create a strong goodwill in the labour market, and also be able to attract the best employees.

- The fringe benefit is considered to be non-taxable earnings for employees. Therefore, employees get the real value.

- It is considered to be a smart technique to motivate the employees to work harder and also erase the dissatisfaction towards the organisation.

- Providing fringe benefits is a great chance to eliminate jealousy and ungratefulness among the employees.

- Providing fringe benefits brainwashes employees that the organisation cares for them.

Why Do Management Invest In Providing Fringe Benefit?

Every organisation wants their employees to work with full potential and dedication. But what happens when employees get out of the line, de-motivated to work, or even attend to the office timely?

Therefore, applying different types of employee engagement policies, employee benefit strategies, and fringe benefits is the only way to get safe from unproductive situations.

Applying such types of strategy helps to hold the loyalty of the employees, encourage them to be more productive, and, of course, recruit talented potential candidates.

Reasons Behind Investing In Providing Fringe Benefit:

- Helps to re-generate the employee's perception of the organisation

- Companies might lose money if any employee misses a day because of illness.

- Employees might feel demotivated by doing monotonous work; hence, offering holidays or health care insurance is important.

How To Calculate The Fringe Benefits?

Yes, providing fringe benefits to employees might cost some penny from the companies’ expense budget.

That’s why organisations calculate and compare the employee’s annual salary and expected cost waste in organising the fringe benefit. The fringe benefit is expressed as a certain percentage of the salary of that employee.

Common Ways To Calculate Fringe Benefits Are To:

Total cost of fringe benefit + total payroll tax(employee received)

salary the employee earned a year

Advantages And Disadvantages Of Fringe Benefits from HR Perspective

Of course, there are some major pros and cons of providing fringe benefits to employees with excellent accomplishments. Below are some common pros and cons of providing fringe benefits:

Advantage Of Fringe Benefit from HR-End:

- A huge source of employee motivation. Only highly motivated employees can bring more productivity to the organisation.

- Employee turnover rate will be reduced. Of course, it's costly to find a replacement for the resigned employee.

- Employees' educational support. Providing such financial support to an employee gives a huge mental relief.

- Better health and wellness of employees. Providing such health/ life insurance or different wellness programs assist in staying healthy and reduce medical cost.

Disadvantage Of Fringe Benefit From HR End

- Under-potential candidates can get attracted because of too much social promotion of the fringe benefits giving ceremony.

- It might increase the administration cost in the long run.

- This benefit is only for some specific employees; therefore, it is hard to cut the cost of fringe benefits.

Conclusion

The types of fringe benefits in HRM vary from one organisation to another, and their value goes beyond mere compensation.

Providing a comprehensive package of fringe benefits can help attract and retain top talent, enhance employee morale, and contribute to a positive workplace culture.

Moreover, it can improve overall job satisfaction and well-being, ultimately benefiting both employees and the organisation.

FAQ- Frequently Asked Question

1. What do you mean by fringe benefit in HRM?

Ans: Fringe benefit in HRM is considered as a part of "employee benefit,". Hence, it refers to any non-wage compensation or extra compensation that an employee receives as part of their total compensation package in addition to their regular salary or hourly wage.

These benefits are provided by the organisation-end to attract and retain employees, enhance job satisfaction, and improve overall employee well-being.

Organisation-end offers these benefits not only to attract and retain talented employees but also to promote the well-being and work-life balance of their workforce. The specific benefits provided can vary widely depending on the industry, location, and company policies.

2. Does fringe benefit count as income?

Ans: Yes, fringe benefits do count as income and will be added to the employee’s gross income section. Also, they will be subjected to income tax withholding and employment tax.

3. Are fringe benefits taxable? Type of tax free fringe benefits?

Ans: According to the IRS, fringe benefits are taxable. It is better to consult with the Employer's tax guide before making any application for fringe benefits.

Type Of Tax-Free Fringe Benefits:

- Athletic facilities

- Dependent care assistance

- Educational or training assistance

- Employee discounts

- Employee stock options

- compensated cell phone bills

- Subsidised lunch, snacks, etc

- Transportation facilities

- Retirement planning service

- Working condition facilities

4. What is a cafeteria plan?

Ans: A cafeteria plan, called an employee flexible benefit plan, allows employees to choose from a menu of different pre-tax benefits. These benefits can include various types of insurance coverage, retirement savings plan options, and other fringe benefits.

The term "cafeteria" is used because it implies that employees can select the benefits they want in a manner similar to how they might choose items from a cafeteria menu.