List of Top Internet Banking Apps in Bangladesh 2025

The Internet banking sector of Bangladesh has continued to grow with the top Internet Banking Apps in Bangladesh.

Now do you know, can these meet the customers' entire needs and expectations?

Internet banking apps and mobile banking apps in Bangladesh have become more efficient and feasible compared to the old days. This radical change in the online banking system in Bangladesh has been possible through the involvement of top Internet banking apps in Bangladesh.

Recently, there has been phenomenal growth in the use of Internet banking apps in Bangladesh. According to the source, a record number of 7.44 million internet-banking users increased in July 2023 from 6.25 million in Dec and 5.47 in July 2022.

Besides, according to Bangladesh Bank statistics, the Internet banking transaction volume rose from TK 235.48 billion in July to TK 275.59 billion in December 2022.

So, in this article, I will demonstrate the top Internet banking apps in Bangladesh. Also, I will break down related topics about Internet banking such as definition, types, pros and cons.

What is Internet banking?

Internet banking also known as online banking, web banking or virtual banking, is a system that allows customers to conduct banking activities like financial transactions through the bank's website. This banking system is typically connected to the bank's core banking system.

However, Internet banking offers a wide range of features to almost every corporate and personal e-banking service.

Generally, Internet banking features are electronic payment, deposit funds, obtaining statements, checking account balances, and registering new accounts.

Besides, there are also transfer funds, checkbook requisitions, paying utility bills, making recharge & merchant payments, applying for insurance, etc. Following the effectiveness of Internet banking, the banking industry needs to implement a complete banking ERP Software.

Types of Internet Bankings

Generally, the bank provides three different types of Internet banking services. Through these types of services, customers can enjoy numerous e-banking services. Here are three main types of Internet banking services:

1. Transactional Internet Banking

Transactional Internet Banking is a type of money transaction-related Internet banking service. You can conduct money-based transactions like fund transfers, utility bill payments, and money deposits through your banking account and password via the Internet.

2. Informational Internet Banking

Informational Internet Banking is a basic-level banking service that provides information related to banking products, policies, and services. Customers can query for detailed information via email.

3. Communicative Internet Banking

In this Communicative Internet Banking, customers can perform simple communicative functions such as applying for loans and fund transfers regarding their account balances. Besides, customers can query for general information through the bank's virtual chatbot.

Advantages of Internet Banking

Internet banking offers numerous online services to customers. So, they can easily use their banking accounts in top internet banking apps in Bangladesh to get banking services. Most of the banking services are open for Internet banking customers. The most significant advantages of Internet banking are as follows:

Funds Transfer:

You can transfer money from one account to another through Internet banking. Otherwise, you can send funds using money transfer channels like NEFT, IMPS, and RTGS to intrabank domestic and international transactions.

Available 24/7:

Internet banking is the fastest and most efficient way. You can enjoy 24/7 hours banking service throughout the year. Also, you can check your account balance at any time, anywhere. So, you can transfer funds if the bank is closed at any time.

Simple Interface & time Efficiency:

Internet banking offers a simple interface to use banking terms easily. You can open a bank account & enjoy banking add-ons, and make money transactions to any account worldwide within a few seconds while sitting at home. Moreover, you can transfer funds instantly if both transactional accounts are from the same organization.

Utility payments and balance Recharging:

You can pay all your utility bills, for instance, electricity, water, Gas bills, etc, via Internet banking. In addition, you can enable auto-debit options to pay bills without missing payments. Also, you can effortlessly recharge your mobile balance at your home.

Add-on Services:

You can apply for add-on services, including taking loans, buying insurance policies, and selling or buying mutual funds. Also, you can enjoy auto payments for all of your recurring expenses.

Account Tracking & checking:

with Internet banking, you can easily track your account constantly at any time, from anywhere. Further, you can check your balance and download your previous account statements.

Top Internet Banking Apps in Bangladesh: 10 Best Online Banking Apps

Bangladesh's banking industry is constantly working to improve the performance and functionality of Internet banking apps. The user volume of Internet banking has increased tremendously in recent years. Now let me introduce you to the top Internet Banking Apps in Bangladesh based on our short list of online bank lists in Bangladesh.

1. City Touch App

City Touch is the best all-in-one banking app out of all online banking apps. The first private commercial bank is City Bank in Bangladesh which developed this digital Banking Service application.

Citytouch is one of the best Internet banking apps in Bangladesh. It offers a simple interface for doing banking terms from anywhere. This app will give you an account number and password when you register to log in.

After that, you can track and manage your account for checking balances, transactions, cash withdrawals or deposits, buying prepaid cards, etc. Besides, you can also load money to your debit card or Bkash or Nagad Wallet.

Citytouch App Information

App Size-Varies with the device

App Latest Download Version-8.1.1

Last Updated On-Dec 28, 2023

Content Rating-PEGI 3

Developed By-The City Bank Limited

Language-Support both English & Bangla

Category-Free Finance App

OS- Android 13.0

License-Free

Key Features of the Citytouch App

- Fund Transfer and Deposits

- Multiple card (debit/credit) management

- Personalization & Customization Customer service request

- Fixed deposit (FDR) or Monthly deposit plans (DPS) through the app

- Instant Utility bill payment options include internet, electricity, mobile phone bills, etc.

- General Banking Checquebook Requisition & cheque Stop Request

- Citytouch transaction details and transfer history

- Statement view and download account statement

- Online shopping bill payment system across Bangladesh

- Fund transferring to VISA debit cards for 18 enlisted banks.

- Scheduling payment system for specific dates and times.

- Compitable for Air ticket purchases from domestic airlines like Regent Airways, Novo Air, USbangla, etc.

- Help to find the nearest City Bank Branch Location.

The Citytouch Banking app approached the old customers and attracted many new customers to migrate their accounts to City Bank because of its outstanding and convenient performance.

2. Brac Bank Astha App

Brac Bank Astha is one of the top online banking apps in Bangladesh. BRAC Bank launched this "Astha" app in 2022. Astha is a mobile app that allows QR-based transactions. Using this app, you can enjoy the most secure digital mobile banking experience, saving time and money.

Further, you can open a deposit and fixed deposit accounts with this mobile banking app. However, customers can do banking services with this mobile app. Here are the features and app information of the Astha app:

Brac Bank Astha App Information

App Size- 55.8 MB

App Latest Download Version- 1.3.9

Content Rating- PEGI 3

Developed By- Brac Bank Limited

Language-Support English

Category- Free Finance App

OS- Android 13.0

License-Free

Key Features of Brac Bank Astha

- Fund transfer to any Brac bank account and other bank account

- Quick mobile top-up

- Mobile Recharge

- Utility bill & credit card bill payment

- Qubee bill payment

- Loan account information

- Detailed and mini Account statement review

- Beneficiary management

- Two-factor authentication security system

- SMS banking with the authentication security system

- Location map to find nearby branches of Brac Bank and ATM booths

- user-friendly and straightforward user interface

- reservation payment system or internet booking

- reward points for each transaction made through the QR platform

- DPS and FD Facilities.

- Changing pincode, blocking, and card activation

So, the Brac Bank Astha is a free Android application with various features. You can use this app through the Internet if you have an active Brac bank account with a debit card or credit card. You can visit the Google Play Store or Mac App Store for the Brac Bank Astha app.

3. EBL Sky Banking app

EBL Sky Banking app is a top banking app among the top Internet banking apps in Bangladesh for business. It is a valuable and convenient app for managing banking needs. It is a leading mobile banking app based on mobile phones by Eastern Bank Limited. So, EBL customers can access all banking terms through the smartphone or tab from anywhere.

This app lets users check their transaction history, account activities, and balance checkings in real-time. Further, users can open fixed deposits and monthly deposit plans (DPS) and manage their account balances with the best banking experience.

Information on the EBL Sky banking app

App Size- 87.1 MB

App Latest Download Version- 1.3.9

Developed By- Eastern Bank PLC

Language-Support English

Category- Free Finance App

OS- Android 12.0

License-Free

Key Features of the EBL Sky banking app

- Fund Transfer from EBL credit card to any account of other banks or Bkash account.

- Skybanking web available

- RTGS fund transfer

- Credit card statement view and download

- Use Visa Cards for QR payment in merchant points

- Account Statement View and Download for up to 6 months (Available in web version only)

- Use VISA Cards for QR Payment in Merchant Points

- You will have bill payment facility for Link3 ISP (Internet Service Provider)

- You can payment EBL credit card bill through EBL Prepaid Card

- Instant self-registration and card block system

- Instant password reset or change of card and account.

- Fingerprint login and more effortless fund transfer

- AKASH DTH bill payment option

- Augmented Reality AR) feature to find the nearest EBL branches and ATM

- Mobile recharge and Utility bill payment

- Use an EBL prepaid card for EBL credit card payment and an EBL or Bkash account.

- Access to account information, credit card details, service requests, product information, and ZIP Partner list.

However, the EBL Skybanking app combines security, convenience, and innovation to provide seamless service to customers. Users can easily enroll in all the services that they need.

4. NexusPay App

Nexuspay is the first fully cardless solution developed by the Dutch Bangla Bank in Bangladesh. Moreover, Dutch Bangla Bank launched 1st mobile banking in Bangladesh on 31 March 2011. Users don't have to carry cash when they have the NexusPay app. If users need to make payments, they must scan a QR code or send money to the seller or biller. It works with all bank cards, including Nexus, Visa, MasterCard, Dutch-Bangla Agent, and Rocket Mobile Banking.

Moreover, Nexuspay is a top mobile banking app in Bangladesh that provides constant banking services. Its user-friendly interface and advanced features have transformed people's banking management system.

NexusPay App Information

App Size- 26.5 MB

App Latest Download Version- 1.0.4.63.21

Developed By- Dutch Bangla Bank

Language-Support English

Category- Free Finance App

OS- Android 22.0 and above

License-Free

Key Features of the NexusPay App

- Full QR and NFC payments system across the entire DBBL network

- Cardless ATM withdrawal (rollout in progress)

- You can receive money using QR, Phone, NFC, Rocket and card number

- It combines the other bank's cards and DBBL's Rocket, Nexus, and Agent Banking systems.

- Produce 10-minute temporary card numbers for online payments.

- Pay electric and gas bills easily

- You can quickly transfer money across all systems

- Merchant payment using Bangla QR and proprietary

- Use NPSB and BEFTN for banking transfer

- Complete account detailed statement view and Mini statement view and download (DBBL only)

- Track the last transaction statement (DBBL only)

- You can block or deactivate your card (DBBL only)

However, NexusPay internet banking software makes banking services more accessible, faster, and more convenient.

5. MyPrime App

Prime Bank has developed an Internet banking app, MyPrime. This app gives you full access to banking terms, including checking balances, transferring funds, paying bills, recharging phones, etc. In addition, you can view account activities, transfer history, credit card bills, deposit balances, etc.

Besides, Myprime is available 24/7 for its clients. This app is optimized for all Android that allow using your existing Altitude login ID. You can do all this via the MyPrime mobile app. Search for the Primebank App on the Google Play Store. Download and begin your mobile banking experience, ensuring internet access.

MyPrime App Information

App Size- Varies with the device

App Latest Download Version- 2.1.0

Last Updated On- Jun 19, 2023

Developed By- Prime Bank Ltd

Language-Support English

App Package- bd.com.primebank.pib.altitudemobile

Category- Free Finance App

OS- Android 22.0 and above

License-Free

Key Features of the MyPrime App

- Super fast and secure sign-in with biometrics (available on all capable devices).

- Full access to your Prime Bank Credit Cards.

- Snapshot of your accounts, cards, deposits, and loans on one screen.

- Transfer funds frequently to any bank account in Bangladesh.

- You can pay utility bills, insurance, tuition, and VAT/CE payments.

- Pay immediately Prime Bank or any bank’s credit card bill.

- You can recharge your mobile phone

- Check statements of your accounts, cards, deposits, and loans.

- Request your new checkbook, stop payments, and send positive pay instructions from the app.

- Open FDR/DPS instantly.

- Apply for loans

- Don’t miss the exciting offers.

- Manage your profile settings.

- Manage multiple accounts easily.

- You can use contact information

- You can use the live chat feature for instant answers to your questions.

However, Prime Bank has 146 branches and 170 ATM locations. It is one of the best banks for its corporate and institutional banking expertise and innovative digitalized banking services.

6. MTB Smart Banking App

The MTB Smart Banking app is an efficient mobile banking app developed by Mutual Trust Bank in Bangladesh. Among the top Internet banking apps in Bangladesh, it is another significant top Internet banking app. This innovative app allows users constant banking access with a wide range of features. Clients can manage their financial activities with Mutual Trust Bank very prominently with this app.

Besides, the MTB Smart Banking app has the latest tab MPay which enables MTB users to make QR-based transactions. Download the MTB Smart Banking app from The Google Play Store. Then login with the MTB Internet banking user ID and Enjoy smart banking.

MyPrime App Information

App Size- Varies with device

App Latest Download Version- 5.0.9

Last Updated On- Dec 29, 2023

Developed By- Mutual Trust Bank Ltd

Language-Support English

Category- Free Finance App

App Package- com.mtb.mobilebanking

OS- Android 13.0

License-Free

Key Features of the MTB Smart Banking App

- QR payment with EMI

- Airport meet and greet service request

- Payment of utility bill and mobile top-up from card

- A-Challan

- Form-C Submission

- Binimoy UI Improvement

- Bug fixing

- Check Account Statements and download

- Cheque Book Requests services on a block option

- Fund Transfers to other MTB bank accounts

- Easy mobile top-up facility

- You can pay Utility Bills

- Advanced credit card services & bill payments

- Locate and find all MTB Branches and ATMs

However, MTB is a private commercial bank with 119 branches, 33 sub-branches and 310 modern ATMs. It offers fully integrated real-time Internet and SMS Banking services with its MTB Smart banking App.

7. SC Mobile Banking App

Standard Chartered Bank SC has introduced a mobile banking app SC mobile banking app. This app helps SC clients make their banking management faster, more secure, and more convenient. This app lets you buy tickets, pay bills, and send money to your bKash account. In addition, it allows you to track your banking account, including your deposit account, transaction history, etc.

Therefore, SCB Online Banking Bangladesh has the simplest and most essential features of an Internet banking app. Hence, the biometric login facility has added extraordinary security to this app. Banking offers and promotional ad directories go automated in the app inbox.

SC Mobile Banking App Information

App Size- 77.1 MB

App Latest Download Version- 3.1.0

Last Updated On- Nov 25, 2023

Developed By- Standard Chartered Bank PLC

Language-Support English

Category- Free Finance App

App Package- com.sc.mobilebanking.bd

OS- Android 13.0

License-Free

Key Features of the SC Mobile Banking App

- You can access accounts quickly.

- Utility bill payments

- Fund transfer to other SC Bank users' accounts.

- Monitor your online transaction histories, overview, and password

- Simple user interface

- Track your account details and manage your account

- Pay bills and make transfers whenever you need

- bio-metric login service

- Mutual Funds and Deposit products

- You can manage deposits, loans, and multiple cards (debit/credit).

- Two-factor authentication (2fa) system & user security for highly secure service.

- Scheduling payments for specific dates.

Therefore, Standard Chartered Bank has 26 branches and 83 ATMs providing beyond traditional banking services. The quicker service of the SC mobile banking app empowers users to make informed decisions about their funds.

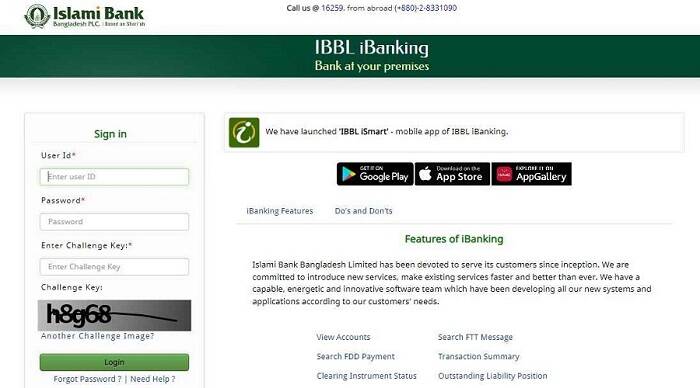

8. iSmart App

iSmart is a cutting-edge internet banking app in the list of top internet banking apps in Bangladesh. To make services faster, more convenient, and pro-level, Islami Bank Bangladesh Limited has launched this app. iSmart has become a go-to platform for users with its easy user interface, diverse banking services, and advanced security measures.

Moreover, the iSmart app has proactively provided digital transaction services since its beginning. This app offers comprehensive features and services to enhance banking experiences.

Information of iSmart Banking App

App Size- Varies with device

App Latest Download Version- 4.5.0

Last Updated On- Jun 22, 2023

Developed By- Islami Bank Bangladesh Limited

Language-Support English

Category- Free Finance App

Content Rating- Everyone

OS- Android 13.0

License-Free

Key Features of the iSmart Banking App

- Advanced features include FTT Message, Search FDD Payment, Clearing Instrument Status, and Outstanding Liability Position.

- You can access posive Pay Instruction, iTransfer, iRecharge, iTransfer-EFT.

- Utility Bill Pay, Card Services, Bulk Recharge, Buy Air Ticket, Transaction Summary,

- You can use VISA Money Transfer, rGP Wallet Refill, RTGS Fund Transfer, and NPSB Fund Transfer.

- Also, you will get to Manage SMS Alerts and download the Cheques Cost Sheet.

- Allows you to Buy Air tickets, Bulk Recharge, Card Trans History, iCashRemit, Create Tasks, etc.

Therefore, Islami Bank has the most extensive network of 394 branches, 228 sub-branches, and 380 ATM booths with the iSmart App.

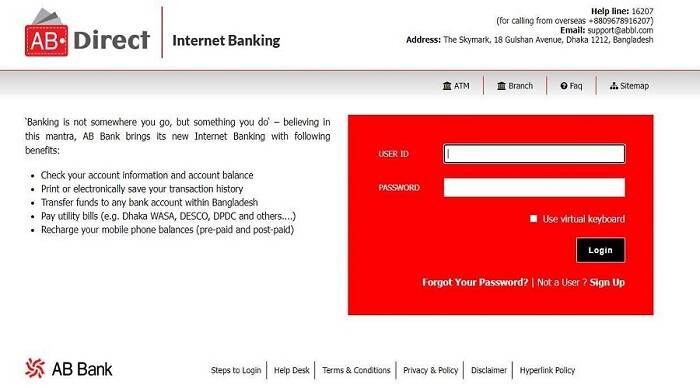

9. AB Direct

"Banking is not somewhere you go, but something you do." – believing in this mantra, AB Bank Limited has developed a leading Internet banking app in Bangladesh AB Direct. This outstanding app offers a seamless and effective platform for clients to manage their banking. Hence, this app ensures a smooth and intuitive banking experience, including checking account balance, viewing transaction history, performing transactions, and various banking services,

Moreover, the AB Direct app incorporates advanced security measures to secure user's financial information. So, secure your banking app, follow the best practices such as using strong passwords, keeping your device and app updated, and avoiding sharing confidential information.

Information of AB Direct App

App Size- 38.82 MB

App Latest Download Version- 1.6.8

Last Updated On- Nov 19, 2023

Developed By- AB Bank Ltd.

Language-Support English

Category- Free Finance App

Content Rating- Everyone

OS- Android 05.0 and up

License-Free

Key Features of the iSmart Banking App

- Boost up security for online transactions (2FA)

- Monitor your account information and account balance

- Download or electronically save your transaction history on your devices.

- Transfer money easily to any bank account in Bangladesh

- Easy bill payment process and pay utility bills (Dhaka WASA, DESCO, DPDC, and others)

- Recharge your mobile balances (pre-paid and post-paid)

- Easy navigation of the nearest AB Bank branch and ATM locators

- Pay your AB Bank MasterCard credit card bills online

Sonali eSheba is an e-service mobile banking app introduced by Sonali Bank Limited. It is the first app of Sonali Bank to offer guidelines on how to open an online bank account in Bangladesh. You can open an online bank account by submitting the necessary documents, such as a NID or passport. Besides, it allows you to pay travel tax, passport, BUET, school, and income Tax fees.

This Internet banking app ensures operational experience as well as customer expectations, providing better services. This app has exciting features, and many more will meet customers' needs and demands.

Information of Sonali eSheba App

App Size- Varies with device

App Latest Download Version- 2.3.2

Last Updated On- Dec 26, 2023.

Developed By- Sonali Bank Ltd.

Language-Support English and Bengali Language

Category- Free Finance App

Content Rating- Everyone

OS- Android 13.0

License-Free

Key Features of the iSmart Banking App

- Sonali eSheba is Secure, Reliable, and Flexible.

- You can enjoy banking services without any extra hassle.

- You will receive a notification after taking any service.

- Support both languages English and Bangla.

Sonali Bank Limited is jointly working with the Bangladesh Govt. to implement the agenda of Digital Bangladesh by introducing this app.

Disadvantages of Internet Banking App

Internet banking is a convenient way to make transactions. But this has some limitations and disadvantages. Some of the disadvantages of Internet banking are as follows:

Limited Amount Withdraw

you can not withdraw large amounts over a certain amount at the ATM because of card limitations. You have to visit the bank's branch to withdraw money. At the same time, if you need to deposit money, you have to visit branches.

Requirement of Internet

You can access Internet banking services only while you have an Internet connection. Further, you can face problems if the bank servers are down.

Transaction Security

online hackers always try to decrypt banking transactions to gain financial benefits. Banks take precautions to avoid & prevent these hacking activities but still pose a significant threat to some accounts. So, clients should use their data network rather than public wifi networks.

Protecting Passwords:

Customers are required to enter passwords to access their accounts. You should keep passwords secure to avoid password theft from fraud. Besides, clients should change their passwords frequently while getting Internet banking services.

Summing Up

Undoubtedly, Bangladesh's online banking system has been revolutionized with the emergence of top Internet banking apps in Bangladesh. So, a successful bank future depends on a perfect Internet banking app with the best performance, security, liability, and functionality.

However, adopting an excellent banking ERP solution can increase the robustness of Internet banking applications. Banking ERP solutions offer a modern core banking system with automated banking operations and CRM solutions.