A Details Guide of Payroll Software for Small Business

Are you eager to know about payroll software for small businesses? Do you want to perceive the overall aspects of payroll software? If so, you need a proper guide that will help you provide a direction to understand the ins and outs of payroll systems. Your craving for learning has helped you to reach the right place. This article is like a container that accommodates several pieces of information about payroll management systems.

Moreover, this article will cover all of your queries that you are looking for on any payroll platform. It will be better if you know before investing because it can reduce cost, save your time, and elevate your employee's satisfaction. You can also learn the process of evaluating which payroll platform will play the best role for your business.

So, let's deep dive into the main focusing part in the article!

What is Payroll in HR?

Payroll refers to the process of paying salary from the employer to the employees. This system also can manage the salary structure, including salary, allowance, deduction, and total compensation of any business. Mainly the HR or accounting department can handle all the activities of payroll software for small businesses.

Payroll processing software can be able to perform some additional tasks such as paycheck processing, insurance, employee benefits, tax withholding, and so on. So, the business payroll software can assist in calculating the net amount of compensation that is the major expense and always deductible from the gross income of any organization.

What Are the Types of Payroll System?

Before investing your worth, you need to know about the types of payroll methods. Otherwise, you do not undertake which method will be perfect for your business. Thus, you need to know various aspects to choose a payroll platform that will ensure smooth tracking of all transactional records. Considering your convenience, here some common types of payroll programs are discussed below.

Manual Payroll Management

The manual payroll process can undertake to manage the overall tasks by hand. When you have few employees, you can apply the manual payroll management system. But there are some possibilities of happening any kind of errors.

As the overall process is managed by hand, so it is quite natural to occur any mistake. So, you need to be more conscious about these matters. The main advantage of this method is that it is so inexpensive, and there must be required some accounting knowledge to operate the entire process.

With this process, employees can manage wage and tax calculations, hand-write paychecks. Also, you can use a typewriter to keep the payroll-related data in the storage box. This process is a little bit difficult for adding and removing employees from the employee list. Thus, there is a chance for data duplication and omission of your system.

Payroll Outsourcing

Outsourcing payroll means some external agencies that can provide payroll services. If your organization does not have any person to manage the payroll-related activities, you can take help from the payroll outsourcing agencies. Moreover, you can take these services according to your business requirements and paying cycle.

The outsourcing agencies can be able to provide your employee salary information and other data like attendance, expense, total compensation, leaves, and so on. The payroll service provider can manage any kind of statutory compliance and calculate the overall payroll.

Thus, this process is a comparative time-saving and cost-effective approach to operate the payroll-related activities. It can save your employees time, and they can invest their time to do other duties. Also, the payroll outsourcing agencies provide online payroll solutions that can allow employers to access all employee's data or information.

Using Payroll Software

If you want to run the payroll operations successfully, you need to adopt a computerized system. This process is the best way to reduce your workload and eliminate errors. Moreover, it can help to calculate employee's wages and deductions accurately.

With the payroll software, you can enter the employee's work status, allowance, and filing status into the payroll platform. The main advantage of using payroll software is to reduce the friction to get the inputs. Also, this software can be able to calculate all transactional records of your employees automatically.

As a matter of fact, its working activities are not limited only to keeping and calculating the transactional records. Rather, it can also smoothly perform the overall leave and attendance management. According to the requirement and size of your business, you need to choose the best payroll software.

Some Basic Differences Between Payroll Software, HCM, and HRIS

Some beginner entrepreneurs do not realize the fundamental difference between payroll software, HCM, and HRIS. When you want to purchase a payroll service for your small business, you might have a clear concept about the payroll software, HCM, and HRIS. Here, I will discuss the differences between HRIS, payroll software, and HCM.

HRIS (Human Resource Information System)

The Human Resource Information System can handle all of the tasks of the HR department, such as recruiting, employee training and development, employee tracking, benefits administration, and so on. Are you interested to know about the HRIS system? If yes, you can visit here to learn more details.

Payroll Software

Payroll software acts as an assistance of the HRIS system. Moreover, you can handle the salary structure and total compensation with the payroll system. It can help to operate the HR-related tasks smoothly based on real-time data and observation. This system can also manage the leave and attendance management that will help to perform the employee tracking activities efficiently and successfully. So, the payroll software can conduct not only the payment-related tasks but also automate repetitive tasks.

HCM (Human Capital Management)

Human Capital Management can operate several tasks such as employee onboarding, employee reviews, employee productivity analytics, and more. The HCM acts as a central point of all organizations. It can affect the overall HRM system because the HCM can ensure better performance and maximize revenue for any organization.

Moreover, you can quickly evaluate the employee's performance, and this process can allow global analytics as well. Mainly there is not a massive difference between HRIS and HCM. Both of them are a little bit similar or interchangeable, and the purposes are not different. Thus, based on your need, you can choose any of them.

Read more about: What is the Difference Between System Software and Application Software

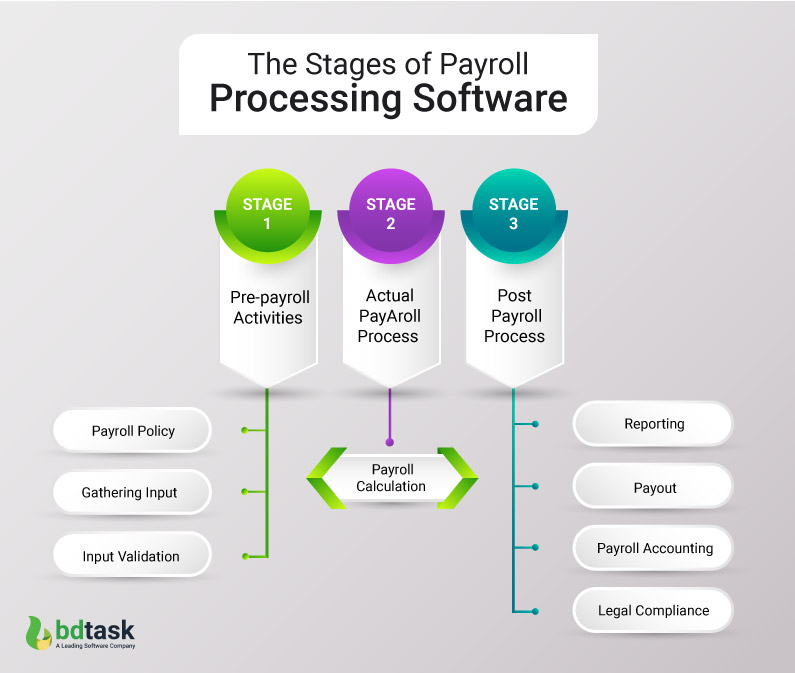

What Are the Stages of Payroll Processing Software?

There are mainly three basic stages of any payroll processing system. Those are pre-payroll activities, actual payroll processing, and post-payroll processing.

What Are the Benefits of the Payroll Management System?

From the above discussion, you already clear about the payroll system and its types, as well as the differences between payroll, HRIS, and HCM. There are lots of remarkable benefits of using a payroll system, and it will help to make strategic decisions. Without using the payroll service, you can not run your business easily. Now, I will describe some effectiveness of payroll services for small businesses.

Reduced Error

One of the greatest advantages of payroll software is that it can reduce the chance of errors in your system. When you handle all of your transactional records manually, there will be a massive chance to occur any kind of errors. However, the payroll platform can be able to perform all transactional analysis accurately. So, I think it will be your one & only destination!

Cost-Effective

The main target for all business owners is to minimize cost and maximize profit. The payroll software system can ensure the best service rather than a traditional paper-based system. Moreover, the payroll management software can save your money and handle all of the tasks efficiently. Also, you can manage several kinds of activities such as employee adding, payslip generating, and compensation managing through a single platform.

Data Privacy & Security

Data is the most crucial asset of all businesses. Are you concerned about data privacy or security? The main concerning part of all entrepreneurs is to keep their system safe and secure. In addition, the payroll-related data is so sensitive and valuable for the security purposes of your business. Thus, you need a system that can be safe from all types of data from any kinds of hacking or threats, and the payroll management software can ensure to do this.

Time-Saving

If you handle manually to calculate the total compensation, it will be very time-consuming, and this process can kill your valuable time. When you are looking for an alternative solution, you can move to an automated payroll software system. The payroll software can save your valuable time and effort. This software can help to manage all the tasks easily and simultaneously.

Usability

It is the most significant advantage of any software. If you have payroll software, you will get this facility. It can allow you to maintain all data in a single storage, and there is no need to allocate multiple files. Moreover, this system can provide an in-sync system with attendance and leave management. So, you can easily operate the entire process without any coding knowledge.

Enhance productivity

This software helps to create a complete automated system. As a result, you can efficiently handle all the activities and quickly perform any tasks through this system. On the other hand, the traditional system is responsible for becoming less productive for your employees.

Reliability

This one is another advantage of the payroll system. It can provide authentic and precise reports that will be workable for your business. Also, this software can be able to generate the latest tax information according to the IRS.

Accurate Calculations

The payroll management software can ensure accurate calculations. If the number of employees increases, it will be very difficult to calculate all records manually. Also, you need more than two or three people to handle such kinds of tasks. However, the payroll software can produce all reports accurately and perform an error-free calculation.

Speedy

You can perform the entire process of preparing payroll quickly with the help of payroll software. This software can generate instant reports and statements within a few seconds that will help to reduce your workload and increase the efficiency of your business. Also, you can access any essential reports with just a few clicks, and there is no need to wait for a couple of days or hours.

Technical Support

If you use advanced payroll software, you can get any technical support to operate the system. It is one of the major benefits of payroll software systems. So, this software not only reduces your business cost but also minimizes your stress to conduct the overall system.

How Can You Choose the Best Payroll Software for Small Business?

Before purchasing any payroll software, you need to ensure some criteria. Otherwise, you can not choose the right payroll system for business. Thus, it is one of the most daunting tasks to choose the best payroll software, and it seems terrorizing, time-consuming, and stressful.

You must need to know some way to pick the best payroll software that will save your time and ensure your business success. So, let's start.

1. User Friendliness

Any user-friendly system helps to increase the user's experience and enhance the ease of usability. As a startup entrepreneur, you obviously do not prefer a complex system because it will be very time-consuming for you.

Moreover, you need to train your employees to operate an advanced payroll management system. When you choose user-friendly software, there is no need to face any extra hassle, and you can easily manage the entire system.

2. Simple Configuration

The best payroll software always offers a simple configuration, and there is no need for any additional requirement to set up the entire system. If your chosen software has a data importing system, it will be very convenient for you because you can import your necessary data from your previous software. So, you need to be ensured about this matter before choosing any payroll system.

3. Affordable

Price is the main controller to move the purchase intention. Sometimes the higher price is responsible to decrease sales even though the software has a lot of exclusive features. As a beginner entrepreneur, you do not afford the higher price because that may create a negative impact on your business. So, it will be very useful if you choose affordable software for your organization.

4. Security

Using the payroll software, you can handle various sensitive information such as account details, social security records, salary structure, and more. So, you definitely need to ensure data security and safety because this feature is one of the essential aspects of any system.

5. Processing & Calculation

Calculation and processing is one of the useful features that can produce an accurate calculation. This feature can allow you to understand the net pay, bonus records, holiday pay, overtime, and more. So, effective payroll software can assist you to reduce the time of cranking out spreadsheets and make strategic decisions and forecast budgets.

6. Tax Compliance

The best payroll software has an excellent feature that is namely a tax compliance system. This feature can allow you to calculate and deduct the payroll taxes accurately. There are several types of payroll taxes that will be deductible from remuneration. When you manually handle this process, it will be very complicated for you. But the payroll management software can be able to perform the process quickly and efficiently.

7. Reporting System

Reports can help to visually represent your business performance and activities. But it's not an easy task to prepare the overall reports precisely. To make the entire report of your business's activities and performance, you definitely need several employees. But if you choose an effective payroll system that can be capable of preparing accurate reports, it will be very fruitful for your business success.

8. Geotagging

With the geotag feature, you can get enough flexibility for time tracking and fraud detection. Moreover, this feature can ensure a secure payroll processing system. Also, you can track on time and GPS location from where the employees clock in until they clock out. So, this feature can help you to evaluate how effectively your workforce can utilize their time.

9. Time Tracking

Time tracking is one of the most remarkable features of any payroll software system. The payroll software can allow you to track each and every time of your employees. It helps to increase your productivity and enhance your business revenue. So, you must be conscious of this feature before purchasing.

10. Sustainability

Before selecting the payroll processing software, you need to be sure that you will get this feature. This feature can assist to boost up your business and enhance the experience of both users and employees. Moreover, this feature can allow you to provide real-time access to get any data or information.

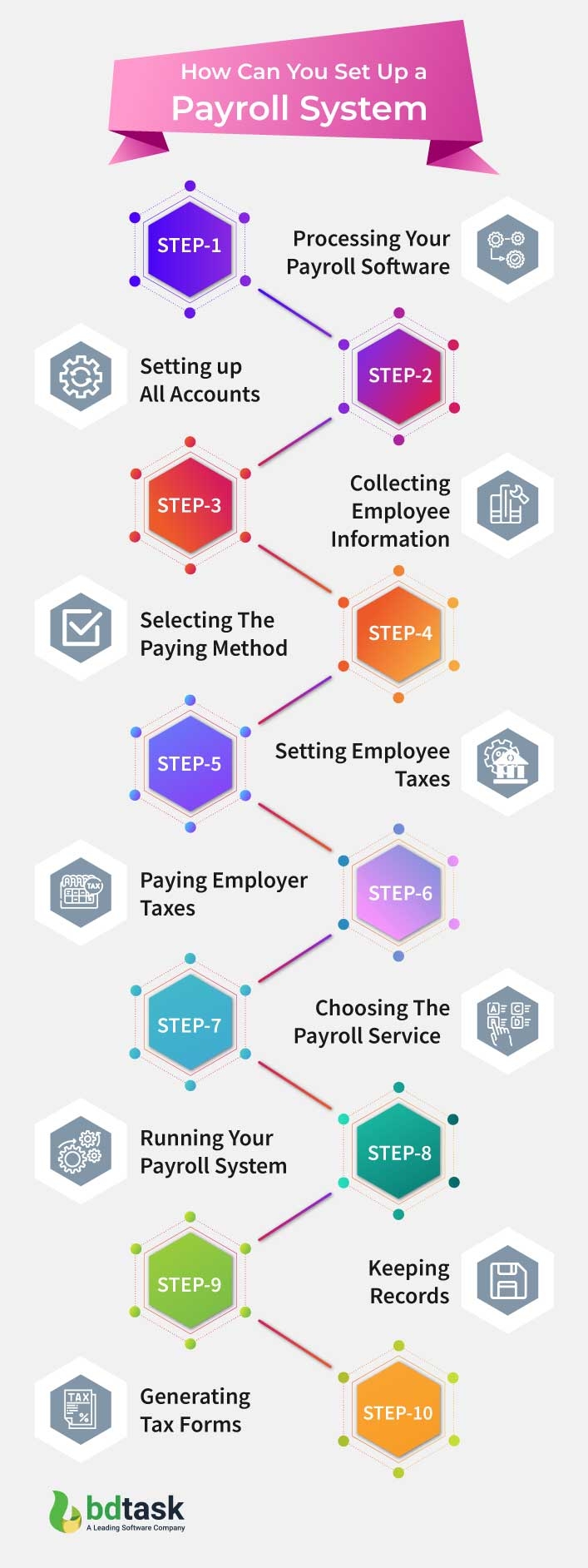

How Can You Set Up a Payroll Management System?

After purchasing payroll software, you need a direction that will help you to set up your payroll processing software.

Top 5 Payroll Software for Small Business

Proper evaluation can help to understand the clear comparison. Before purchasing any payroll software, you need to evaluate which software will be better for your business. To perform this evaluation, I will provide a brief explanation of the top 5 payroll management software.

HR Manager

Do you want to increase your business interactivity? HR Manager helps to make your business more productive because it has some exclusive features. It is the most reliable platform for managing your payroll activities.

- Effective payroll management system

- Integrated with mobile application

- Effective recruiting process

- Provides tax management system

- Accurate account management system and more!

Gusto

Gusto is one of the best and effective online payroll service platforms. Most probably, this software is connected with 100000 small business entrepreneurs. It can provide an automatic calculation system and some additional features. These features will assist in managing your business.

- An effective time tracking system

- Integrated with Gusto wallet

- Compensation management system

- Provides subscription-based system

- Allows compliance management and more!

Sage Payroll

Are you looking for the cheapest payroll software for small business? Sage Payroll software can provide some useful features that will enhance employee experience. Also, it can help to create a better engagement with your workforce.

- Cost-effective system

- Integrated with the talent management system

- Generates accurate reports

- Provides data security system

- User access permission system and more!

QuickBooks Online Payroll

QuickBooks Online Payroll software is one of the most popular payroll systems. This system can allow you to access all employee services and manage everything. Also, you can get tax penalty protection, time tracking, auto payroll, and more features that ensure your smooth operation.

- Provides inventory management system

- Allows employee self-service system

- Accurate cash flow management

- Effective income and expense management

- Bill management system and so on!

SAP SuccessFactors

SAP SuccessFactors is mainly beneficial for the human capital management system. However, it can manage all payroll-related activities successfully. As it can provide a cloud-based software solution, so there is no required installation cost. Moreover, this software has some excellent features

- Integrated with an effective payroll timesheet

- Provides recruiting management

- Allows talent management system

- Accurate HR analytics

- Allows compliance auditing systems and more!

If you want to learn more examples of payroll services for your small or large enterprises, you can visit here.

All of Your Attempts May Fail for One Wrong Decision!

Payroll software plays a crucial role because it can involve looking after the critical asset for all businesses. Also, it can handle the total inflow and outflow of cash. The payroll management software can manage any company's payroll and tax-related activities. So, you need to choose the best payroll software for your business success.

"The best payroll software acts as a financial controller of any organization."

According to the previous discussion, you can easily pick out the right payroll management system. Moreover, the payroll system can ensure accurate accounting to calculate the salaries, taxes, bonuses, and more. In fact, the best payroll software is more reliable, flexible, and convenient for any calculation.

So, the best payroll software can ensure your business prosperity and helps to fulfill your dream. Otherwise, all of your attempts may fail because of an outdated financial management system.

The Best Payroll Software Ensures Almost 7.1% of Industry Growth!!!

Payroll software undertakes some major responsibilities of any organization because it can generate accurate reports. An accurate report is a key asset that helps to obverse the current situation of your business. When you understand the present condition, you can easily meet up with the situation and take the necessary steps to overcome it.

"Business success and sustainability almost 90% depends on the best payroll software."

Moreover, the payroll platform can be able to calculate any transactional records quickly but accurately. As a result, it will help to save your time, but an outdated process is very time-consuming, and there is a huge chance of any inaccuracy.

The most significant thing is to choose the right payroll software. It's not an easy job to select the best one because there are numerous payroll platforms available in the present era. However, this content will help you to identify the best payroll software for your small business.

So, it's time to choose the best payroll software for small business that will be very convenient for you and your organization.

Final Words

Now I have come to the ending part of the article, and I appreciate you reading this. Obviously, payroll processing is a far difficult and challenging task, but the payroll software can perform all the activities easily and smoothly.

The payroll system can also enhance the employee experience that plays a vital role in increasing your business productivity. So, the best payroll software for small businesses is worth the investment.

Would you like to read: Accelerate Your Business Growth with 15 Best Business Management Software