How to Calculate Manufacturing Overhead Costs with Formula

Manufacturing overhead is also known as factory overhead, factory burden, production overhead Or manufacturing support. Sum all of the indirect factory-related expenses that are incurred during the production of a product while calculating the manufacturing overhead costs. Let’s explore how to calculate manufacturing overhead costs with a formula.

One thing you must remember is that manufacturing overhead costs don’t include charges such as general administrative expenses and marketing expenses.

When a business makes a product or service, it incurs two sorts of expenses including operational and overhead. The direct costs of producing a product are included in operational expenses like material, labor, etc.

On the other hand, overhead expenditures are not directly tied to output, but they are required to keep the company running like rent, electricity bills, taxes, and other indirect costs. These are part of the cost of running a business.

In this article, you will get an overall idea of the manufacturing overhead costs and the types of manufacturing overhead costs. Moreover, learn the manufacturing overhead formula with examples.

What is Manufacturing Overhead Cost?

In American English, manufacturing overhead cost is called factory burden, or work overhead. It is the entire cost of running all of a manufacturing company's production facilities. Manufacturing overhead usually refers to indirect labor and indirect expenses.

Depreciation of equipment, salaries, pay provided to manufacturing employees, and electricity. It's utilized to run the equipment are all included in the manufacturing overhead costs.

In a word, manufacturing overhead costs are the out-of-pocket charges or indirect expenses that keep a business running.

Examples of Manufacturing Overhead Costs

A manufacturer doesn't only need the labor cost and the cost of the raw materials to manufacture a product but also the electricity, factory supplies, and other expenses.

- The production building's rent

- Factory's utilities

- Factory management team salaries

- Manufacturing equipment depreciation

- Maintenance workers' salaries

- Manufacturing facility and equipment property taxes and insurance

- Computers and communication systems for a manufacturing facility

- Salaries of quality control personnel Factory supplies that are not directly related to products

- Material handlers' remuneration

- Wages for cleaning crews

You Might Also Like: Grow Business with Enterprise Resource Planning (ERP) Systems

What are the Types of Manufacturing Overhead Costs?

Manufacturing overhead costs are called indirect costs since they are difficult to link to specific products. These costs are transferred to the final product based on a predetermined overhead absorption rate.

Manufacturing overhead costs are different in type. In the below section, the manufacturing overhead costs are classified based on several parameters.

Types of Manufacturing Overhead Costs Based on Behaviour

The behavior of manufacturing overhead is used to classify it into different sections. Some overhead costs fluctuate in response to the amount of product generated, while others do not.

Based on behavior, there are three types of manufacturing overhead costs.

Fixed Overhead Costs

Fixed overhead costs remain constant regardless of production output which means it doesn’t change depending on the production volume or activity while manufacturing. Fixed overhead costs include rental costs, monthly or yearly repairs, and other fixed costs.

For instance, even if your company decides to reduce production for this quarter, you must continue to pay the same amount for renting office or manufacturing space. So these types of costs are more or less fixed.

Variable Overhead Costs

The variable overhead costs are not fixed. The volume of output has a direct impact on variable overhead expenses. As a result, the more things you produce, the higher your costs.

Shipping fees, advertising campaigns, invoices for using the machinery, electricity uses while manufacturing, and other expenses directly determined by the quantity of manufacturing are examples of variable overhead costs.

Semi-Variable Overhead Costs

Semi-variable overhead costs are not fully fixed. These types of costs are partially fixed and partially variable. In a word, the semi-variable overhead costs are that they are both variable and fixed.

They don't fluctuate directly in proportion to production output as they comprise both a fixed and variable component. These types of costs include telephone rates, equipment repairs and maintenance, and so on.

Companies must pay their electricity bill every month, but the amount they pay is determined by the size of their operation too. For instance, the bill rises during months of high output and falls during the off-season.

Types of Indirect Costs Related to Manufacturing Overhead

The manufacturing overhead expenses per unit of activity such as labor costs, labor hours, and machine hours are referred to as the overhead absorption rate. Manufacturing overhead costs can be categorized into the following categories according to the behavior.

Let’s see the five types of manufacturing overhead which are related to indirect costs.

Financial costs

Financial overhead costs can’t be avoided as it consists solely of financial costs. These costs include property taxes, audit and legal fees, and insurance policies that the government may charge on your industrial facility.

These costs aren't fluctuating all that much, and they're spread out across the full product inventory.

Physical costs

The physical goods required for manufacturing are included in these expenses. They often include the cost of the production facility and its depreciation, the cost of purchasing new machinery, the cost of repairing new machines, and other comparable costs.

Indirect labor

The expense to the company of employees who aren't directly involved in the product's creation is known as indirect labor. Security guards, janitors, plant managers, machine repairmen, supervisors, and quality inspectors, for example, are all examples of indirect labor expenditures.

Indirect materials

This expense is incurred for materials that are utilized in the production process but cannot be linked to a specific product. Consumables like machine lubricants, light bulbs, and janitorial supplies account for the majority of indirect material costs.

For example, the wood pulp used in the paper industry is not considered an indirect material. It is largely utilized in the production of paper as a direct material. However, the lubricant necessary to keep the machinery working smoothly is an indirect cost imposed during the papermaking process.

Utilities

Utilities, such as natural gas, electricity, and water, are overhead costs that vary depending on the volume of commodities produced. Depending on market demand for the goods, this could increase or decrease.

However, the direct manufacturing costs include all the costs to produce a product perfectly such as the raw materials costs, labor costs, variable and semi-variable costs, etc.

You Might Also Like: 20 Best ERP Software for Small Businesses of 2025

What is the Manufacturing Overhead Formula?

Before calculating manufacturing overhead cost, let's get a clear view of the formula. There are several ways of expressing the formula for calculating manufacturing overhead. These include:

- Manufacturing overhead = Total manufacturing overhead / Total units produced.

- Manufacturing overhead = Fixed manufacturing overhead + Variable manufacturing overhead / Number of units produced.

Or suppose you want to calculate the total Total Manufacturing Overhead

Cost then the formula is

- Total Manufacturing Overhead Cost = Fixed + Variable + Semivariable Overhead Costs.

Calculating manufacturing overhead costs is important in managing any company's manufacturing operations. Knowing what factory overhead includes can make the entire manufacturing process more efficient. As a result, it helps you track any indirect costs associated with manufacturing your products.

How to Calculate Manufacturing Overhead Costs?

The manufacturing overhead costs include all indirect costs. You have to identify the manufacturing overhead costs first to calculate the overhead costs.

The calculation of the manufacturing overhead costs can be done either by determining the total overhead costs or the per unit basis.

Sum up the Total Overhead Costs of the Manufacturing Process

In this article, we have already discussed the type of manufacturing overhead costs. Now it’s your turn to identify your manufacturing overhead costs.

In this case, you can take a look at your monthly expenses report where the entire costs are enlisted.

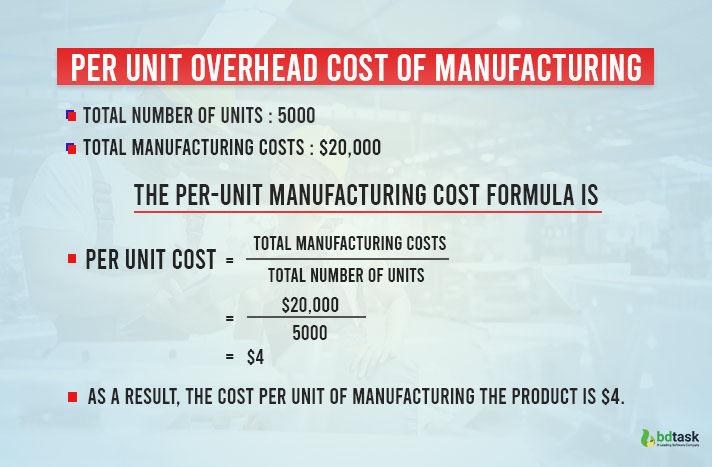

Per unit Overhead Cost of Manufacturing

For example, a company manufactured 5000 products of the same item. The required total cost of the manufacturing process is $20,000. Now, it’s an easy process to calculate the per-unit cost.

Now you can calculate your expected unit within a second. Suppose, you need 8000 units more to manufacture. In this case, just multiply the expected unit with the cost per unit of manufacturing the product.

Expected total manufacturing overhead cost: Manufacturing overhead cost per unit X Total number of units

= $4 X 8000

= $32, 000

So, you will need total overhead costs of $32, 000 to manufacture the expected number of units (8000).

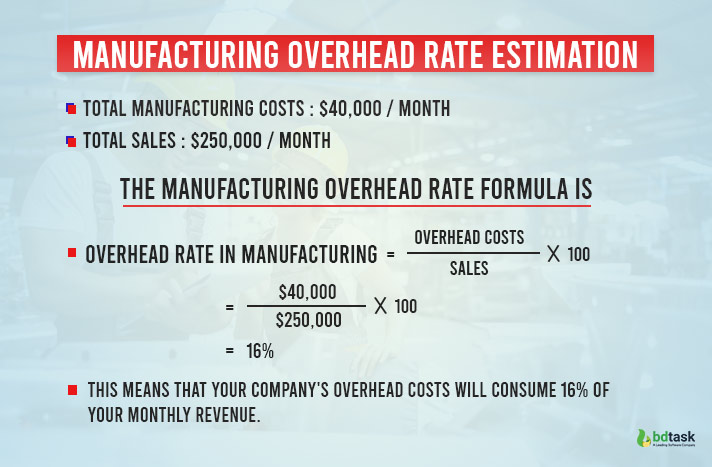

Manufacturing Overhead Rate Estimation

You must determine the manufacturing overhead rate after evaluating the manufacturing overhead costs for a month. This is the monthly percentage you must pay for overheads.

In this case, divide your monthly overhead costs by your total monthly sales. And to get the overhead rate multiplied by 100.

Suppose, a company requires $40,000 per month as the total manufacturing overhead cost and the monthly sales are $250,000. How can you determine the manufacturing overhead rate?

However, if your company’s manufacturing overhead rate is low, it means that your manufacturing process is efficient. On the other hand, if your overhead rate is greater, your manufacturing process is defective.

So the lower your overhead rate is better for your company’s revenue.

How to Calculate the Allocated Manufacturing Overhead Costs?

A part of the manufacturing overhead must be allocated to each item produced. Because it is required to comply with GAAP to get a manufacturer's financial statements.

You have to calculate and apply the overhead rate to allocate manufacturing overhead costs. It will provide the manufacturer with the true cost of creating each item if this is done in a standard way.

1. First, calculate the total manufacturing overhead costs. Although some of the costs are fixed and some are variable which is already explored in the above part of this article.

Some costs are related to production. If your production increases, your cost will increase. On the contrary, your costs will decrease, if your production decreases.

2. Now you have to choose the allocation base. It refers to the overhead costs which are assigned by the company to manufacture the products.

Direct labor hours and direct machine hours are the commonly used allocation bases in the manufacturing process.

3. Calculate the manufacturing overhead costs. Then divide the manufacturing overhead costs by the allocation base. Here the allocation bases are the labor hours that are needed to produce the product from the beginning to the final step.

4. You can identify the total allocation base by reviewing the payroll records and the maintenance details of the factory.

5. Find out the overhead allocation rate by dividing the manufacturing overhead cost by the total direct labor hours.

Now you can get the hourly labor cost to manufacture a product.

6. Finally you calculate your every hour direct labor cost for every type of product.

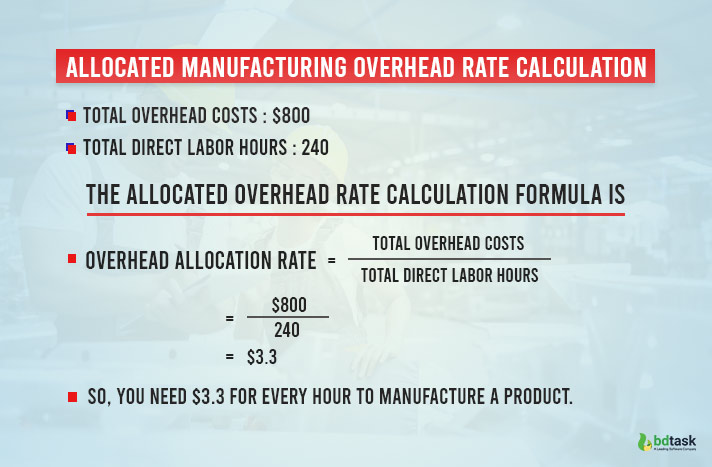

Allocated Manufacturing Overhead Rate Calculation

Suppose, your total manufacturing overhead costs including indirect labor costs, indirect materials, and other production costs are $800.

The direct labor hours to produce the products including product A(180 hours) and product B(60 hours) are 240 hours. How can you calculate the allocated manufacturing overhead rate?

Now you can estimate the total costs easily. If you can determine your costs for a specific product, then follow the below estimation.

For instance, you need 180 hours to produce product A. (Per-hour wage is $10)

So your direct labor cost for product A = 180 X $10

= $1800

For product B, direct labour cost = 60 X $10

= $600

Total direct labour costs = $1800 + $600

= $2400

Overhead costs for product A = 180 X $3.33

= $599.4

Overhead costs for product B = 60 X $3.33

= $199.8

Total overhead costs = $599.4 + $199.8

= $800(almost)

Total costs = $2400 + $800

= $3200

However,

For Product A

Direct labour costs = $1800

Overhead costs = $599.4

Total costs = $1800 + $599.4

= $2399.4

For Product B

Direct labour costs = $600

Overhead costs = $199.8

Total costs = $600 + $199.8

= $799.8

Total costs = $2399.4 + $799.8

= $3200 (almost)

So if your labor spends 240 hours and overhead costs $800, you can calculate your total costs of $3200 by following the above formula.

You Might Also Like: 10 Best HR Software for Small Business

Final Words

Using proper manufacturing overhead formula is a necessary aspect of running a business effectively. Tracking these expenses and sticking to a budget will help you assess how efficiently your company is operating and, in the long run, cut overhead expenditures.

However, this article explained the types of manufacturing overhead costs, and how to calculate them with the manufacturing overhead formula. Now calculate your manufacturing costs and evaluate your cost benefits.

Read Also: