How to Trade Cryptocurrency and Make Profit - A Beginner's Guide

Cryptocurrencies are digital or virtual tokens that use Blockchain technology to secure their transactions and control the creation of new units. Cryptocurrencies can be exchanged between people and businesses, and some are used to purchase goods and services. Nowadays, more people are doing Crypto investments, but many are not making profit because they do not have the proper knowledge. You may have also heard about how you can make a profit of a thousand percent in a short period by investing in Cryptocurrency. The truth is that you can profit more than that, depending on how much you invest, but it is not as easy as it may seem. There are many different factors that you should take into account before jumping into Cryptocurrency trading. In this article, I will provide a beginner's guide on how to trade Cryptocurrency and make profit.

What is Cryptocurrency?

The name Cryptocurrency is a purposeful combination of two important ideas. Crypto in Cryptocurrency stands for Cryptography, the discipline of writing or solving codes. Then Currency in Cryptocurrency means money in any form as a means of exchange.

On Crypto networks, anybody can verify everyone else's money, how much they have in their accounts and their transaction history. Volunteers are constantly adding data to a public digital ledger, a collection of all financial accounts and transactions known as the Blockchain.

Any user that wants to execute a transaction must pay a transaction fee to the volunteer. These transaction fees vary and depend on the Cryptocurrency.

What is Blockchain?

Block refers to a block of information, and Chain refers to new blocks of information being added to existing blocks or a chain of blocks.

The term Blockchain refers to a type of database in which a collection of computers operated by different individuals in different locations is constantly adding information. In other words, Blockchain refers to the digital public ledger where individuals constantly add information about digital Crypto transactions.

Why are we investing in Cryptocurrencies?

Crypto is an opportunity to build a decentralized currency system based on majority consensus. This means that the whole system has pretty high integrity. We are eliminating the need for banks or middlemen to control money accounts and transactions.

Now, as a result of all that Crypto networks are immutable, they cannot be altered or deleted from immutable transactions made. It is extremely difficult or nearly impossible to manipulate data stored on the network. It's not just stored in one place, it's stored all over the place, and that also means that it's partially immune to government shutdown or intervention.

A general centralized ledger contains all the accounts and transactions in one spot. So, for example, a bank would have total control over which transactions are posted on this ledger. Since they are controlling it, the ledger owner can manipulate or shut it down, giving it more authority than optimal.

A distributed ledger (Blockchain) is basically like a shared ledger. It's different from that general ledger. There are no central administrators. It is sort of like an asset database that all the participants within the network share. So, if there's a change in the ledger, everyone will see that, resulting in more transparency.

Why do you need to invest in Crypto ASAP?

In the last decade, Bitcoin has grown from around one dollar in 2011 to over 40, 50, and 60 thousand in just one decade.

Crypto is very volatile, so the prices may change. Now Bitcoin is around 20000 dollar. That is pretty insane. Cryptocurrencies are facing many challenges but still becoming popular. The whole Crypto space is still super young and becoming more mainstream. Market experts are predicting a good growth rate for Cryptocurrency.

It is a new way of decentralized currency that the governments cannot control; that's what makes it enticing for a lot of people. It is starting to get more and more financial backing from institutions, financial giants such as PayPal and Square are putting Crypto onto their platforms, which will change the whole Crypto space.

Maria Paula Fernandez, Advisor at Golem Network said that she enjoyed investing in Bitcoin and Ethereum because of the natural ways to minimize the trust layer in governments and organizations that fail to look out for the public and protect individuals from the fragility of traditional financial systems. In addition, they are assets that do not require major parties to verify, create or administrate them. That is how Crypto takes power over banks and governments and puts it into the hands of the investors.

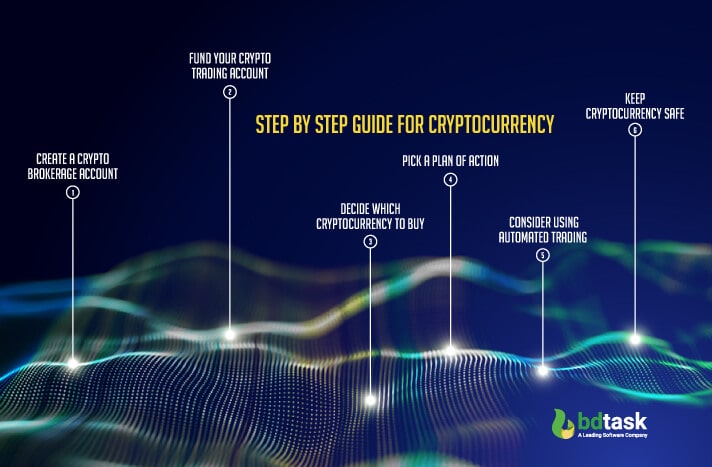

How to start trading Cryptocurrency? [step by step]

Making money by trading Cryptocurrencies is possible, but it can be risky. Before starting Crypto investment determine which type of trader you are and what your goals are. Make sure you are aware of the risks and take precautions.

Let's see the 6 important steps to start trading Cryptocurrency -

Step 1: Create a Cryptocurrency brokerage account

You must sign up for a trading platform or Cryptocurrency exchange if you do not own a Cryptocurrency. Coinbase, Gemini, and eToro are some of the best trading platforms on the market. Each provider offers a user-friendly design and a wide selection of coins.

To gain access to trade Cryptocurrency, you will first need to provide your Crypto brokerage with personal information similar to the stock brokerage registration. Some of the info you need to provide includes your social security number, address, date of birth, and email.

Step 2: Fund your Crypto trading account

Once you have signed up with a Crypto exchange, you need to connect your bank account. Most Crypto exchanges offer funding with a bank wire transfer and debit cards. Wire transfer is usually an affordable option. It’s complimentary on Coinbase and Gemini.

Step 3: Decide which Cryptocurrency to buy

The two most popular Cryptocurrencies among active traders are Bitcoin and Ethereum. Trading with technical indicators may be simpler for these Cryptocurrencies since they move more predictably than smaller altcoins.

Many Cryptocurrency traders devote some of their capital to lesser-known altcoins. Despite having a smaller market cap than large market cap Cryptos, small mid-market cap Cryptos have higher upside potential.

For risk-tolerant investors, many small altcoins have seen price increases of over 1,000% in recent months, making them attractive investments.

Step 4: Pick a plan of action

Numerous trading indicators are available, and most traders buy and sell Cryptocurrencies after considering several factors.

Elliott wave theory is a popular trading strategy that many traders employ for investing. Elliott wave theory is especially effective for speculative assets like Cryptocurrencies because it focuses on the psychology underlying market sentiment.

There are many strategies for Crypto buying and selling. You can do a trading course.

For now, you can read this blog- How to Buy and Sell Cryptocurrency? Top Strategies & Process

Step 5: Consider using automated Cryptocurrency trading

You can try automated Crypto trading with a platform like Coinroll when looking for a trading strategy for Cryptocurrencies. Trading Bots implement a strategy designed to meet your investment objectives while providing you with the best results possible. You can quickly make money, hold your coins, or diversify your portfolio. Automated trading offers a conservative, neutral, or aggressive method.

Additionally, you might think about trading Cryptocurrencies actively on some platforms while utilizing automated trading on others.

Step 6: Keep Cryptocurrency Safe

You must store your money on the exchange to have access to it if you are actively trading Cryptocurrencies. If you plan to hold Cryptocurrency for medium to long-term investment, then get a Cryptocurrency wallet.

Software wallets and hardware wallets are two options for Cryptocurrency wallets. Both are safe but hardware wallets can store your Cryptocurrency on a real offline device. They provide the highest level of security. Many investors choose Ledger as their hardware wallet because of its excellent reputation.

Several iOS, Google, Chrome, and Android options are free to use if you're looking for a software wallet. Some reliable software wallets available to Cryptocurrency Traders are Zengo, BitGo, and SimpleHold. These mobile wallets use secure two or three-factor authentication to protect your digital assets, offering comparable security to other wallets on the market.

Moreover, many wallets offer to buy, sell and earn interest on digital assets directly from wallets.

How to Trade Cryptocurrency and Make Profit Easily

Many people are trying to invest in Cryptocurrency, but many cannot make a profit because they do not have the proper knowledge. There are a few different ways to approach trading Cryptocurrencies and making money, so it is important to gain knowledge to develop your skills in the Crypto field.

By following the below points, you will gain the necessary knowledge on how to trade cryptocurrency and make profit -

Research Crypto

Trading Cryptocurrency mostly depends on how much research knowledge you have to understand the Crypto market. Here are the key points of Valuation Metrics and Qualitative indicators you should know as a beginner for researching the Cryptocurrency-

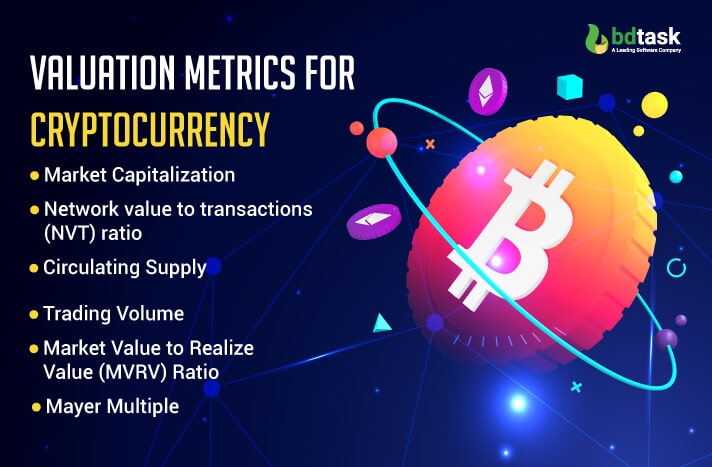

Valuation Metrics

- Market Capitalization:

Market capitalization provides the total market or the network value of a Cryptocurrency. So, to get this, multiply the total coin supply by the latest trading price.

For example, there is a coin out there. There's a total supply of 50 coins, and the latest trading price is 2 dollars, resulting in a market cap of 100.

Now market caps can be a little bit deceptive with any fork. Forks are new software protocols or updates that allow spin-off coins to be forked off of a parent coin. So whenever a new coin is forked off of a parent coin, this new coin will inherit the coin supply of the parent coin, and as a result, new coins can appear to look well established and valuable, so that is a little deceptive.

- Network value to transactions (NVT) ratio:

NVT is the PE or price-to-earnings ratio of Crypto coins, describing the relationship between the market capital and the transaction volume. So to calculate the NVT, take the market cap of your preferred Crypto and divide it by the daily transaction volume.

A lower NVT ratio number is good for Crypto investing. Anything under 15 is probably good, it will be bullish, and anything under 25 is more likely to be bearish.

The price-to-earnings ratio for stocks is similar, but there are no earnings for Crypto. Therefore, these are not like revenue-generating companies, so we have to use the NVT ratio.

- Circulating Supply

It is the approximate number of coins circulating in the market. You can easily find this information on many different sources such as Yahoo Finance or Coinmarketcap.

- Trading Volume

Another important valuation metric is the trading volume which is the number of coins that have exchanged hands in the last 24 hours. The higher the trading volume, the more this coin is being traded back and forth.

The lower trading volume means that there are not as many people buying and selling right now.

- Market Value to Realize Value (MVRV) Ratio

The MVRV ratio is the market value to the realize value ratio. To find this, you have to take the market capitalization and divide it by the realized capitalization.

This result will consider any lost coins or coins that are no longer in circulation. If the MVRV ratio is under 1.5, the coin is undervalued; if it's over 3.5, it could be overvalued.

- Mayer Multiple

The Mayer multiple is another important one: the price divided by the 200-day moving average. So, for example, if the current price is ten dollars and the 200-day moving average is 10, your Mayer Multiple would be 0.1.

Anything under 1 could mean that it could break out and anything over 2.4 means that it could be bearish. If your Mayer Multiple is smaller, the current price is under the 200-day moving average; if this ratio is over one, the current price is above the 200-day.

- Moving average volatility

It is also an important metric because it helps to measure the extent to which a Cryptocurrency's price fluctuates over time. It also measures the standard deviation of the current price relative to the 30-day moving average.

You do not have to worry too much about how these metrics are calculated. A lot of the Crypto websites are going to calculate them for you and show you the number.

You only need to know the Crypto valuation metrics and how to interpret them.

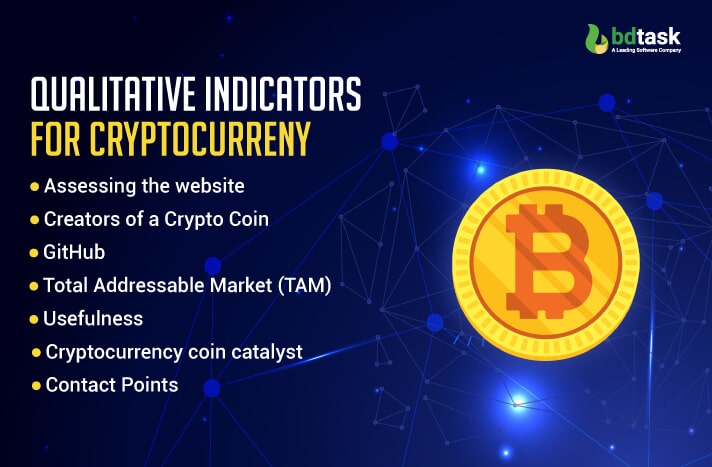

Qualitative Indicators

- Assessing the website

The website has to look good where you want to trade your Cryptocurrency. Look at the aesthetic design and how professional it looks. If it looks scammy, then the coin could be scammy. Check it carefully because so many coins are out there that do not have actual value. They are just scams. So you should see if the website looks good, and you also want to see what information the website presents and if it is transparent.

- Creators of a Crypto Coin

You should know the reputation and the technical background of a Crypto coin creator and whether or not they are trustworthy. Therefore, it will be best if you do some quick research about who founded that coin and whether or not you would trust them.

- GitHub

This platform will show you the code of many of these projects. Then, if you are a potential buyer of that Crypto, you can examine the Crypto network's code and see how it is. This code checking is for advanced and experienced coders and programmers. You probably will not know what is happening, so you can hire or get help from an experienced one.

- Total Addressable Market (TAM)

You may ask how a particular Cryptocurrency will appeal to the market and how it will be creating a new market. So, for example, Ethereum is proposing to revolutionize the development of decentralized apps, so that was a brand new user, and it's something that had a lot of utility to it.

- Usefulness

The usefulness of a Crypto coin means the addressable market, like what utility or value this Crypto can bring. If it's just the cash grab, then it's probably not going to have any utility, but if it does have some usefulness, that is something you want to see.

- Cryptocurrency coin catalyst

These are any unexpected events, announcements, updates, or revolutions to occur with this Crypto. For example, Dogecoin's price can be quite influenced by tweets by people like Elon Musk. This influence can be volatile, and you do not have control over the catalyst because we do not know if Elon musk will tweet something good about Dogecoin or something bad.

- Contact Points

Now for the communication, the questions arrive while researching a Crypto coin - how can potential buyers or investors learn more about the Cryptocoin, how can they reach out to the creator of the coin, and then how frequently do the Crypto creators reach out and update their investors?

These are all things that you should consider when analyzing a specific Cryptocurrency.

White Paper

Reading the white paper is a part of the trading process that most people skip. A Crypto white paper is a document that the creators of that Crypto create, and it helps to sell it. It will include facts about Crypto, diagrams, statistics, and quotes. It is more technically oriented, so many people do not read the white paper.

The basic structure of a Crypto Coin White Paper is given below-

Abstract - A summary of the Crypto Coin.

Introduction - Introduction shows the solution to the present problems.

So, the new user can easily understand how the new Crypto can create value in the market.

Technology

Transaction Technology - This section describes how the Crypto coin is exchanged among users.

Mining Technology - This part describes the Crypto coin's mining process.

Network Technology - The network communication process for sharing information.

Incentive - It is detailed information on why you should choose this Crypto Network over others.

Emission Plan - The nature of the new coin or new tokens and their usage policy are discussed here.

Conclusion - Creators write a review of their Crypto coin that is already discussed above.

References - Necessary citations and sources are included in Crypto White Paper to support their Crypto.

Crypto News Sources

It is extremely important to stay up to date with any Crypto news because Crypto relies on the news and current events. Here is a list of some great news sources for Crypto updates -

Robinhood and Coinbase App - You can buy and sell Crypto using these apps. But they also have a ton of articles and information about Cryptocurrencies.

Coindesk.com - This is a new source for many different Cryptocurrencies, and you can check the price movements and other data there. Coinmarketcap is another website similar to Coindesk.

Coincenter.org - This is a resource for specializing in politics and legislation regarding Bitcoin and other Crypto coins

reddit.com - There is actually a ton of really interesting information on this forum, and there are communities where more experience, as well as beginner Crypto investors, are just interacting. People post links to useful information. There are a lot of intriguing discussions here and the opportunity to talk to other people about Crypto.

Timing The Market

Investing short term is always riskier; it is a little bit safer for the long term. Learn about the strategies for day trading stocks, as these will be similar to when you trade Cryptocurrencies.

You can look into the Bollinger Bands' daily volumes and trading indicators. There is going to be a lot of charting involved. The most important concept is that time in the market beats timing the market most. Day traders may lose money, but most people who stay in the market for a long time are long-term investors and will make money.

Cryptocurrency Index Fund

If you are interested in investing in the Crypto long term but do not want to research each of these coins, you can choose the Crypto20(C20) index fund. It is what it sounds like. You are holding the top 20 coins at any given time when you invest in Crypto20. They are going to readjust the funds every week. So you can earn profits by holding a single token of the fund. It is not necessary to invest here but just another different way of investing in Crypto.

Invest what you can afford to lose.

Conclusion

In conclusion, if you want to make profit from Cryptocurrency trading, it is important to have the knowledge and be able to use tools that will help you. With the right resources, you can make a lot of money quickly. This is relatively a new and largely unexplored market, with many exciting opportunities in store for the future. So, keep researching and learning more about the Crypto market.