Initial Strategy: How To Be A Successful Bank Branch Manager

Indeed, a job in any financial institute or non-financial institute, for instance, a bank, NGO, or microfinance, isn't accessible. In fact, their job is comparatively more complicated than you can imagine. For example, a bank branch manager always needs to be proactive so that they can provide faster service to every customer entering the bank.

In this blog, I will explore "how to be a successful bank branch manager?" and the strategies branch managers apply to make that branch successful.

A bank branch manager always needs a multitasker, a rounder, and leadership quality. It's entirely the bank branch manager's responsibility to manage the whole branch. Starting from monitoring day-to-day operations, greeting new customers, monitoring and increasing the sales of financial products, growing deposits of that branch, approving the loan, and many more.

Who & What Is A Bank Branch Manager?

Financial institutions such as banks open their multiple branches or sub-branches in different locations. As a result, they can reach their targeted customer faster, and without any inconvenience, a prospect can take the service of that bank.

Moreover, to manage this branch or sub-branch, the head-quarter branch assigns a specific bank branch manager, who will be solely responsible for running, managing, and selling different financial services.

Besides, the position “bank branch manager” will only be given to the senior officer who has worked in that bank for at least 2 years. Also, the head-quarter branch will assign another junior assistant officer to handle the responsibilities simultaneously with the bank branch manager.

Some of the core & daily task of a bank branch manager:

- Managing the necessary resource

- Oversee the daily operations

- Maintain the performance of the branch bank

- Meeting with locals regarding loans

- Day-to-day required bank teller

- Participate in different client meetings

- The effort to increase deposits of that branch

Task Designated For A Bank Branch Manager

This section will absolutely portray the job description of a bank manager. Hence, describe the part of the task a bank branch manager must complete daily and monthly. Here is a list:

- Oversee the administration, distribution operations, customer service, human resources, and sale of financial services.

- Meet with the locations and understand the local market condition, and look for prospective sales opportunity

- Construct a "target reaching" goals, set an approximate forecast of deposit, KPI, etc

- Design an effective usage of funds allocated from the headquarter branch.

- It's completely a branch manager's responsibility to train & motivate the subordinates to perform better

- Pinpoint the problematic area and try to bring development in that specific part

- Always give the highest priority to the customers and focus on their satisfaction

- Sit with the senior manager to discuss the performance of the bank.

Million Dollar Question:

How To Be A Successful Bank Branch Manager?

This section is especially important for bank job seekers. Hence I'm going to explore; what type of "educational qualifications," "previous banking experience," and "skills" are needed to be a successful bank branch manager. Because to be a bank branch manager, well-educated and long-run banking experience is absolutely mandatory.

-

Complete Your Business Bachelor Degree

Usually, the first requirement for getting a job in the banking sector is to complete a business bachelor's degree. Business bachelor degrees have different sectors of departments, and if you have any one of the following, you can easily apply and qualify for a bank job. For instance:

- Finance Department

- Account Department

- Marketing & International Business Department

- Supply Chain Management

- Management Information System

In addition, if you wanna apply or want a quick promotion to any higher management position such as principal officer, bank branch manager, or general manager, etc., the applicant must complete the Master's Degree of Administration (MBA).

-

Apply & Get Qualified For A Bank To Start Your Career

Banking careers can start from junior positions and local/national/ international banks.

The banking industry is vast and has several departments, for instance, the RMG sector, general banking, risk management, treasury department, retail banking, compliance department, etc.

The applicant must determine which sector he/she wants to explore and apply whenever banks open up for vacancy. And by using an effective applicant tracking system, HR managers will filter the potential ones.

After the applicant gets called from the HR department, it now turns for the selected applicant to get qualified in the bank by attending 6 to 7 different series of entrance exams plus interviews.

-

Achieve Various Banking Professional Degrees

Indeed, no junior can’t be a bank branch manager, only any senior banker with 4 to 5 years of experience is eligible to be in the “bank branch manager” position of a bank.

Hence requiring a professional banking degree or certificates, for instance, corporate trust specialist, financial planner, regulatory compliance manager, trust and financial planner, chartered alternative investment analyst and chartered financial analyst, etc.

-

Train & Develop The Necessary Skills

The only way to achieve the role in a management position is to keep yourself in continuous development, which can only be achieved by participating in different banking training arranged by the bank authority.

A bank branch manager needs to have expertise in every technical part of banking, strong leadership qualities, and the quality to make crucial decisions in the bank.

-

Apply For Management Positions

To apply for a management-level position, the applicant must have mandatory technical banking expertise, confidence to make critical decisions, and at least 4 to 5 years of banking experience.

The branch manager will get an extra advantage if he/she is from the same bank because he/she then has an advanced idea of the bank's daily operational process, working process, bank objectives, goals, etc.

Aren’t You Curious To Know !!!

What Is An Average Salary Of A Bank Branch Manager?

Doing a job in the banking sector is one risky job. Hence, risky job demands for higher remuneration. This salary will include many other benefits such as health benefits, vision, life insurance, rental, miscellaneous bills,

According to some secondary sources, the average salary of a bank branch manager based in the US range is $62,382. However, the salary differs based on performance, location, experience, etc.

Mandatory Hard & Soft Skills In A Bank Branch Manager

Only a bank branch manager is responsible for all the tasks, transactions, and activities happening in the bank.

Whenever any customer enters a bank, it's the bank branch manager's responsibility to provide the best & fast service. It happens almost every day to make different critical & crucial decisions to run the branch smoothly.

Just to let you know, every branch or sub-branch of a bank is monitored by the head-quarter branch. Moreover, observe the hard and soft skills a bank branch manager applies to maintain the bank environment.

-

Smart Verbal Skills

A bank branch manager always has to be proactive and keep in continuous communication with staff, customers, loan clients, or higher management.

Not only that, but a bank branch manager also has to keep a motivating mood so that he/she can inspire & train junior assistance officers to work better & faster.

-

Customer Satisfaction

Every bank’s branch has been given a designated sales target for their financial service. Hence, a bank branch manager is responsible for achieving those targets by providing the best satisfying customer service.

A bank branch manager must be extremely talented, both in hard and soft skills. In addition, the bank branch manager needs to build a smooth communication relationship with the customer to make the branch profitable.

A bank branch manager must always maintain a humble personality to host the client, listen to their problem and provide the best solution. After all, a bank branch manager can achieve the sales target by building strong customer relations.

-

Must Have The Leadership Skills

A bank branch manager and a junior assistant officer monitors and oversees every activity. Since that bank branch manager is the most senior in that branch, it is his/her sole duty to make important decisions.

-

Technical Literacy

Now we’re leading in the digital generation, where every other organization uses innovative software to provide faster and more efficient customer service.

Like any other organization, an organization like a bank also needs a fast, trusted, and efficient automation banking solution. There are many trusted and customizable banking software solutions in the market; choose your suitable one.

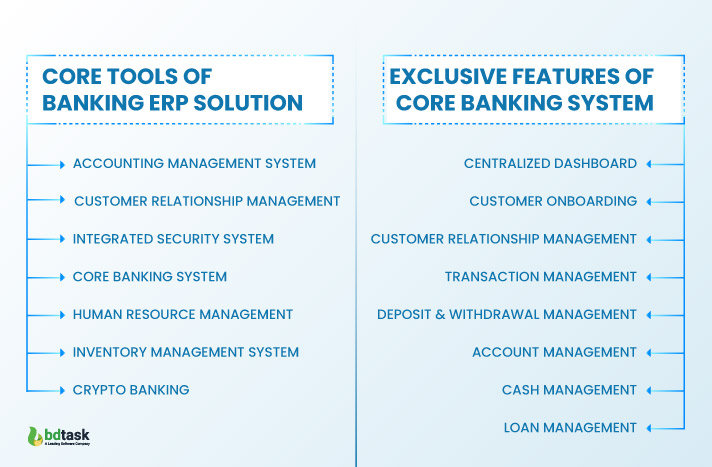

A banking software solution comes up with different exclusive services, which unbelievably help the banking operations to become automated and provide fast service to their customers. The essential service of a banking software solution:

- Core Banking Solution

- CRM Solution

- Account Management Solution

- Crypto Banking

- Integrated Security System

- Automate Banking Operation

-

Analytical Decision Making Skills

Only the bank branch manager has the authority to analyze and grant the approval of different loads, mortgages, and many more. Hence, bank branch managers must be very conscious while evaluating the document.

-

Networking Skills

It’s extremely important for a bank branch manager to maintain a network with different profitable customers, investors, loan/mortgage clients, etc. Networking with people from different sectors can be advantageous for your personal and professional career.

Burning Question!!

How & Where Can You Learn To Be a Bank Branch Manager?

However, I have already described the initial requirement to be a bank branch manager. But, still, there’s some confusion about how a bank branch manager will learn the skill/task to run a bank branch manager.

Hence, to clarify the confusion, a bank branch manager will learn all the tasks “on-the-job-train” and attend different banking training programs, including operation management, loan processes, handling different customer issues, and different bank rules and regulations.

To become a better specialist in bank branch manager, a bank branch manager can gather professional banking degrees from the American bankers association.

One and Only Trust Digital Banking Solution

Restructure Your Banking With Core Banking Solution

ERP banking solution is one dynamic solution that helps a bank branch manager fasten their customer service. Core banking system helps to run the daily transaction efficiently, automatically record financial transactions, cash management, and many more.

This secure banking system makes it easy to conduct customer verification, deposits, withdraws, load management, transparent general ledger, real-time reporting tools, etc.

Conclusion

When the world is adopting a different digital solution for better efficiency, then why will the fintech industry fall behind?

Fintech industries, such as the banking industry, are now also adopting different banking ERP software solutions to automate their customer service. This automated banking solution can help a bank branch manager perform their daily tasks without interruption. Hence, hugely impacts and assists a bank branch manager in taking the bank branch to the successful stage.