Crypto Market Growth Predictions and Challenges in 2025

Cryptocurrency has become an increasingly popular way to invest in the future. It’s also becoming a significant financial part for many of us. Like many other markets, The crypto market has had highs and lows since its innovation. But this new generation of technology is in a state with so much potential to grow. In this article, I will explain the potentiality, challenges, and prediction of crypto market growth.

How big is the cryptocurrency market?

According to CoinMarketCap, the current cryptocurrency market capitalization is more than $1.65 trillion. Furthermore, the all-time highest global crypto market capital was $2.9T in November 2021.

There were just under 1 million active users at the end of 2018. That number grew to almost 600 million by the end of 2023. According to a report of Boston Consulting Group (BCG) the number of crypto users will reach one billion by 2030.

The digital coin market is growing at a rapid pace. Currently, there are more than 12,000 active cryptocurrencies or tokens.

Since it is the first of its kind, Bitcoin has the most market share in the global cryptocurrency market. Bitcoin has successfully stood in the market through many ups and downs but has risen dramatically in recent years. It started at less than $1,000 per coin in 2010. But now, its price has skyrocketed to nearly $43,000. Ethereum is also doing good constantly for the last few years.

Why is the cryptocurrency market down today?

Despite the current economic climate, the cryptocurrency market is not down today. According to CoinMarketCap, the current crypto market capitalization is more than one and a half trillion US dollars. However, there is still uncertainty surrounding the industry's future. The market is still recovering from the massive sell-off that occurred in 2025.

In 2023, the crypto market faced significant challenges. Two big reasons were inflation in the U.S. and traders' bullish confidence. The high inflation rate in the U.S. made it hard for people to invest in crypto. Traders were also very confident that crypto would do well, which made the market unstable. People needed to think about both the economic situation and the traders' feelings when they made decisions about crypto.

Since the fourth quarter of 2023, the cryptocurrency market has been recovering at a healthy rate. From a market capitalization of nearly $1 trillion in mid-October 2023, it began the new year 2025 with more than $1.60 trillion.

Experts predict that if there is no recession in the near future, the cryptocurrency market will see significant growth. As the cryptocurrency landscape evolves, learning how to buy stellar lumens becomes a valuable skill for those looking to expand their investment horizons in the burgeoning market.

Who controls cryptocurrency market?

The cryptocurrency market is overgrowing, and many different types of cryptocurrencies are available. Bitcoin is one of the most well-known cryptocurrencies, but others include Ethereum, Ripple, Litecoin, Dash, Monero, and Zcash. These currencies are traded online and can be used to buy things from websites like Microsoft, Twitch, Starbuck, and Namecheap. There are also other ways to use them, such as sending payments to each other.

Some people prefer using cryptocurrencies because they believe they are safer than regular currency. However, some think blockchain technology, like cryptocurrency, is still risky and volatile.

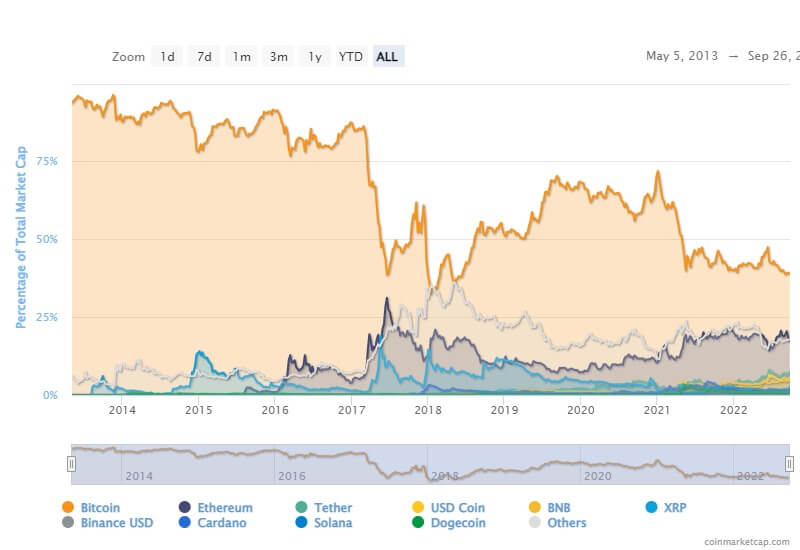

According to CoinMarketCap, the top five cryptocurrencies by market cap are Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), and BNB. These coins make up approximately 90% of the total market capitalization. However, other smaller cryptocurrencies exist, and many are out of the market.

The major cryptocurrencies are Bitcoin and Ethereum. Accordingly, they hold around 49% and 18% of the total crypto market share.

.jpg)

Source: Coinmarketcap.com

Will the crypto market go up again?

There are several reasons why the cryptocurrency market has seen much growth since it creates the market. This blockchain currency technology is very innovative and uses decentralized networks. It allows people to transfer money without using banks or third parties. People can avoid fees and delays associated with traditional banking methods using cryptocurrencies.

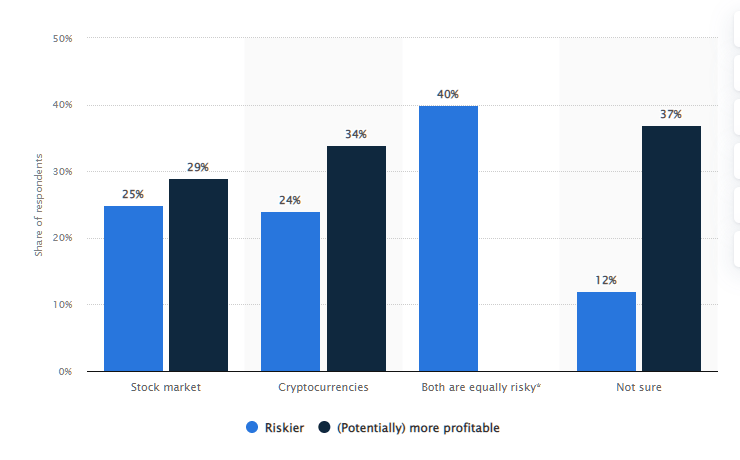

According to a 2021 survey among consumers in the United States published by Statista, people feel less risky and more profitable to invest in cryptocurrencies than in the stock market.

Source: Statista.com

The digital currency market has been volatile lately, with some coins losing 90 per cent of their value in less than a year. However, there are signs that things could be turning around.

The number of users of crypto exchange platforms is growing, allowing people to buy and sell cryptocurrencies, which has increased dramatically since last year. In addition, people can make payments with cryptocurrencies easily by using a crypto wallet.

Meta has enabled digital collectibles (NFTs) to buy and sell on their Facebook and Instagram platforms for creators and collectors. People can quickly enter this market by adding a crypto wallet to their platform.

Giant companies like Meta are coming forward to use Crypto technology. So, there is no going back from Crypto. Crypto will definitely go up again.

Challenges of Crypto Market Growth

Crypto market growth has been facing many challenges in recent periods along with the software and hardware segments (for mining, Crypto exchanging software, crypto wallet, etc.) post-pandemic situations, and some worst international relationships among developed countries. Furthermore, as this technology spreads so fast, it is facing new challenges in building a stable market in the digital era.

Some common challenges for Crypto Market Growth are given below.

1. Internet Availability

Where there is an internet user, there is a chance to use Crypto. Crypto is also an expansion of the internet and software. The Internet is used globally except in North Korea. They have banned the internet from their citizens. Many governments also ban or restrict the internet occasionally. This hampers crypto mining and transactions.

2. New Laws and Regulations

The regulation follows innovation because you cannot regulate something that doesn't exist. Crypto is a new invention. It has created a market, and the market has started to expand. Many countries are not using Crypto yet. Many countries like China (it was a significant crypto market region) have banned Crypto.

Crypto is designed for the global market. There are some laws and regulations for global operation. When it creates a market in any country, it needs to be regulated with its own regulation for the country's safety points. The legal process for forming laws and regulations should be followed to ensure crypto market growth. Financial regulators and governments should pay attention to Crypto to digitize their country's economy.

3. Basic Confusion about Crypto

The use of cryptocurrency is still perceived as confusing, as it was in the early days of the internet. People have thought Crypto is a currency only, but there are 4 significant classifications in Crypto. These are - asset, currency, utility, and security. When people understand this technology, the regulation will be easy for them. However, people need time to emerge with this cutting-edge technology.

People invest in those things which are easy to understand. Crypto investment has less than 10 years of accurate data. Some people are waiting and observing how the crypto market grows.

4. Crypto Tax

Another fundamental issue is the crypto tax. Many of us have no explicit knowledge about how taxes on crypto work. The government should implement proper crypto tax compliance, so people do not demotivate in Crypto investing. We hope that in the future, people will be wiser and more aware of investing in Crypto to reach financial goals.

Some states in America have addressed the income tax for cryptocurrency. However, the government should provide more precise TAX guidelines for digital or electronic money.

5. Public Sentiment

The public sentiment regarding crypto buying and selling in social media and forums can influence the crypto market. Now people are so active in expressing their emotions, and online communication places significantly impacts marketing. Celebrities are so much involved in the movement of a market trend. Greed and fear of public investors influence Crypto market growth.

6. Facing Cyber Threats

As Crypto is a new technology, we have to face new cyber threats like Crypto Jacking. Like other online technologies, Crypto technology is also facing various types of Cyber threats. Cryptojacking is one of the mentionable cyber crimes related to crypto. Crptojacing is the process by which one gets unauthorized access to others' computers and uses computer processing power for free crypto mining for them.

To stop Crypto cybercrime, we must develop updated cyber security programs like antivirus, adblockers, and browser extensions. Otherwise, we can not assure secure crypto swaps and purchases. People will be demotivated then to use cryptocurrency.

7. Corporation Investment

It was considered funny to talk about Crypto investment for publicly traded corporations for an extended period. But many giant companies stepped ahead and changed that thought. Companies like Tesla, MicroStrategy, Block, Voyager Digital, Galaxy Digital Holdings, and Coinbase purchased thousands of Bitcoins worth millions.

Many organizations from various industries regularly invest millions in virtual currency for a better digital world. According to a financial document of MicroStrategy, together with its subsidiaries, they have invested approximately $3.98 billion for purchasing approximately 130,000 bitcoins till 20 September 2022. Many companies like this are now investing and adopting cryptocurrency payment. However, we need more of these types of corporate investments for faster crypto market growth.

In a recent tweet, Michael Saylor, Founder & Executive Chairman of MicroStrategy, talked about the devaluation of different traditional currencies and bitcoin. Actually, his tweet shows the status of cryptocurrency during the recent worldwide inflation and indicates the necessity of corporate investment.

8. Environmental Impact

Elon mask is a big supporter of CryptoCurrency. But he is also concerned about the environmental impact of mining and transaction Bitcoin. So, he paused the crypto payment for Tesla. But later, in response to the Cointelegraph tweet, Elon said that Tesla would resume allowing Bitcoin transactions only when the crypto mining needs reasonable (~50%) clean energy.

Vitalik Buterin, the co-founder of Ethereum, has confirmed a vital upgrade named The Merge, executed on September 15, 2022, and claimed that this upgrade would reduce more than 0.2% worldwide electricity consumption.

Conclusion

We believe that the cryptocurrency market will continue growing this year and in the future. This growth is likely due to increasing demand from new users and businesses and an increasing number of digital tokens and cryptocurrencies being created. We also expect to see more significant announcements and partnerships between digital asset exchanges and traditional financial institutions, which will help to drive further innovation and growth in the market. Financial and technological innovations like cryptocurrencies should not be limited to ensure positive crypto market growth, and government and people will get a desirable economic result.